As discussed earlier, commercial tax varies between states across India. These taxes are levied basis the categories that they belong to. The usual rate of commercial tax for most categories is fixed at 12.5%. Despite the variations in the tax rates, commercial tax in India can be classified under four distinct categories: Zero commercial tax. a bank. a corporation that is authorized under the laws of Canada or a province to carry on in Canada the business of offering to the public its services as a trustee. a person whose principal business is as a trader or dealer in, or as a broker or salesperson of, financial instruments or money. a credit union.

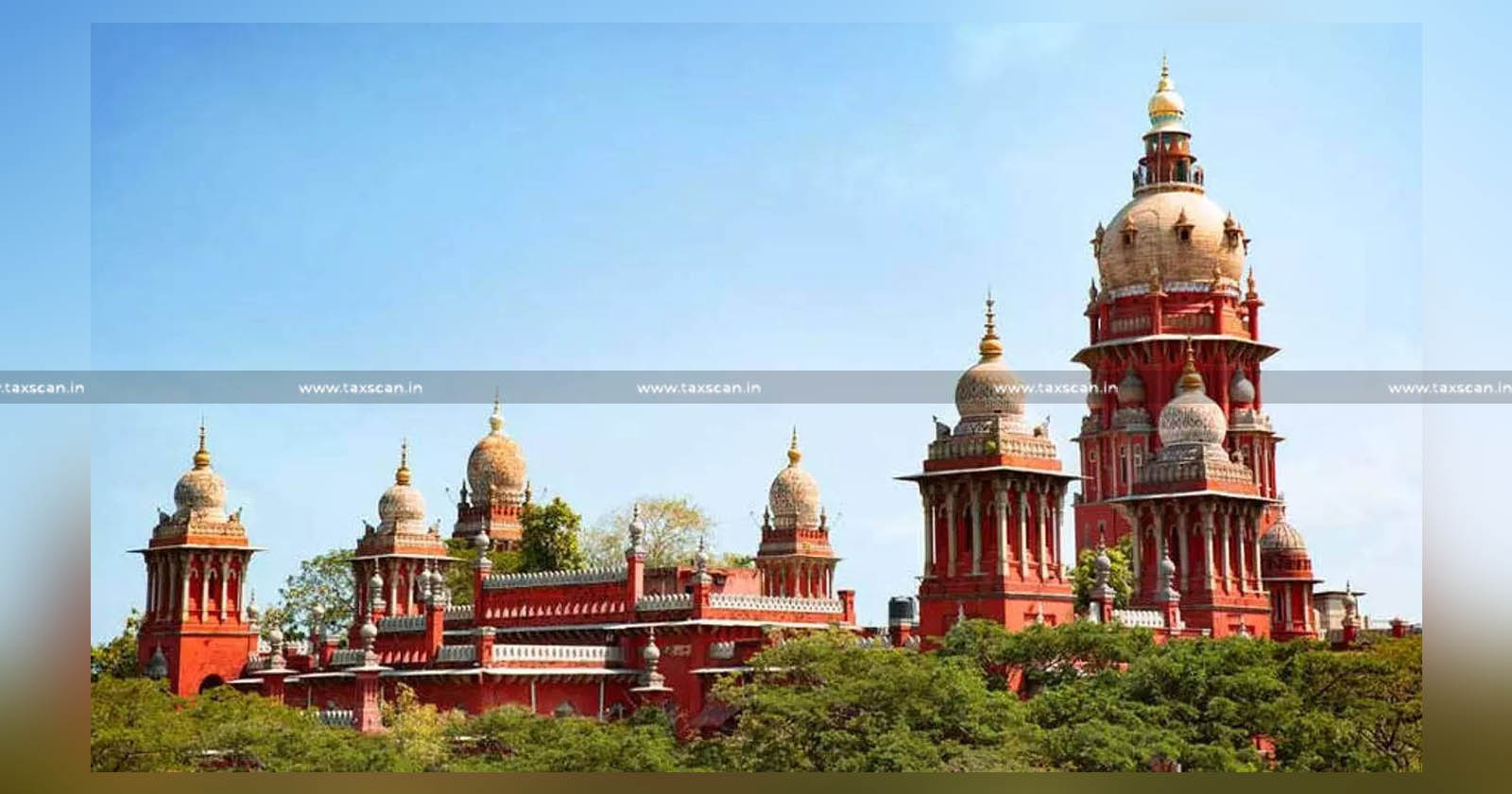

Tax Department conducts searches in Tamil Nadu Here is a complete guide

OSSC ACTO Answer Key 2019 OUT Download Assistant Commercial Tax Officer

Commercial Tax Officer Jobs Know the Qualification, Selection Process, Salary and much more

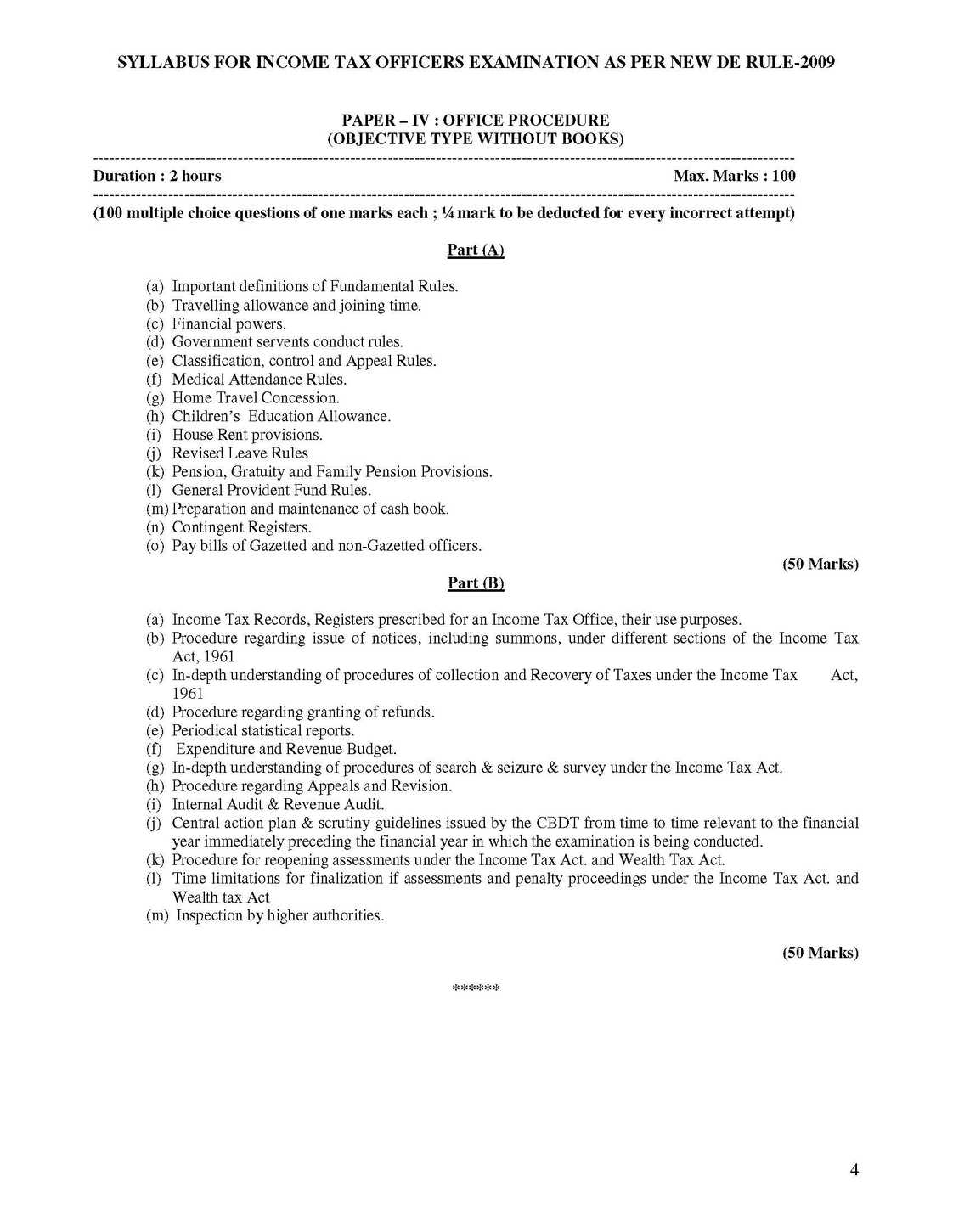

COMMERCIAL TAX OFFICER FEBRUARY 2,2015 FULL SOLVED PAPER EXAMCHOICES.IN

Deputy Commissioner Commercial Tax Officer in ACB Net Hyderabad Overseas News YouTube

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

COMMERCIAL TAX TAXES SYLLABUS EXAMCHOICES.IN

HemalathaBC , COMMERCIAL TAX OFFICER (Rank 29, KAS 2017) mock interview at INSPIRO IAS KAS YouTube

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

KPSC Commercial Tax Officer Syllabus & Exam Pattern 2020 Download

Tax Officer Exam 2023 2024 EduVark

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

CTO COMMERCIAL TAX OFFICER APPSC/TSPSC GROUP 1 JOB PROFILE BY V GLORY YouTube

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

Part III OSSC ASSISTANT COMMERCIAL TAX OFFICER PREVIOUS YEAR QUESTION PAPER

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

Wastage of oil Taxscan Simplifying Tax Laws

Akshar Shah tax Officer) LAKSH Career Academy

The State Trading Corporation has been assessed to sale tax by the Commercial Tax Officer, Vishakhapatnam and a demand has been made upon it. By this petition under Article 32 of the Constitution it challenges the demand on the ground inter alia that the impugned order and the demand for the tax infringe its fundamental rights which are guaranteed to citizens by Article 19 sub-clauses (f) and (g).. Deloitte’s Chief Tax Officer Program is here to help rising and established tax leaders successfully take on new challenges and seize opportunities that come from change and uncertainty. We leverage our deep tax knowledge, multidisciplinary business experience, and vast resources to empower, connect, and inform tax executives in distinct and.